Good morning. NYC’s property values continue to climb, but cracks are forming beneath the surface. The latest assessment roll highlights uneven growth across asset types and boroughs.

🎯 Interested in sponsoring CRE Daily NY? Reach thousands of active owners, investors, and operators across the five boroughs. Get in touch here.

Market Snapshot

|

|

||||

|

|

Assessment Breakdown

NYC Property Values Hit New Highs, But the Details Reveal a Split Picture

The Municipal Building in Lower Manhattan Credit: Ben Fractenberg/THE CITY

New York City’s tentative FY27 property tax roll is out, and while total values are up again, the details hint at deeper shifts across key asset classes.

Big picture: The Department of Finance (DOF) reports citywide market value rose 5.4% to a record $1.659T, with assessed value up 5.6%—slightly below last year’s pace but still a second straight record. Acting Commissioner Jeffrey Shear cited steady residential demand and unexpected strength in offices, hotels, and retail.

Class highlights:

Class 1 (1–3 Family Homes): Market value rose 5.2% to $822.2B, with Brooklyn leading at 6.2% and Staten Island topping assessed value gains. Average single-family home value now exceeds $1M.

Class 2 (Multifamily/Co-Ops/Condos): Market value grew 6.9% to $422.4B. Brooklyn led rental growth (+12%), but tax burdens are rising: Manhattan co-ops average $1,370/month, condos $1,940/month in taxes.

Class 3 (Utilities): State-set values held steady at $65.1B.

Class 4 (Commercial): Market value rose 4.3% to $349.2B, led by hotels (+7.7%), retail (+3.4%), and offices (+2.9%). The Bronx saw the largest commercial value jump at 8.4%.

Manhattan office split: DOF data shows a split in Manhattan’s office market: trophy buildings gained 3.9% in value, while Class A space shrank by 5.55M sq. ft. and lost $1.6B in value—likely from office-to-resi conversions. Top-tier assets remain strong as weaker ones continue to be repositioned.

Misleading rental gain: Unregulated Manhattan rentals rose 4.8% in value, but a DOF reclassification shifted $5B and 50K–60K units to the regulated category, inflating reported gains. Actual market-driven growth for regulated rentals was just 0.46%.

Chase Tower impact: JP Morgan Chase’s new 2.05M SF HQ made a major impact, accounting for 6.2% of all new construction value and helping drive the citywide $11.8B increase from development.

Deadlines & disputes: Property owners can challenge assessments by March 2 (Classes 2–4) or March 16 (Class 1) through the NYC Tax Commission. The same March 16 deadline applies for exemption applications. Despite the pending TENNY case, DOF continues using a 6% assessment ratio for Class 1 homes.

➥ THE TAKEAWAY

Market snapshot: Even with slower growth, NYC real estate keeps breaking records. The FY27 roll highlights a split office market, rising tax pressure on multifamily, and the outsized impact of new construction—especially from big-name projects.

Around New York

➥ NYC multifamily sales plunged 57% in Q4 as Mayor Mamdani’s rent freeze and political uncertainty spooked long-term owners.

➥ Summit Properties clinched a $451M deal for over 5,100 rent-stabilized units from Pinnacle, overcoming fierce opposition from NYC Mayor Mamdani and tenant advocates.

➥ HMart’s Tribeca store remains shuttered as the grocer sues a condo board for imposing strict post-sale rules that allegedly killed the $8M project.

➥ NYC’s universal childcare rollout is hitting a wall as high rents, zoning restrictions, and permitting delays stall new facility openings.

➥ White Plains is transforming with thousands of new rentals, attracting affluent renters and redefining downtown living near NYC.

➥ New York seeks to dismiss RealPage’s suit over its ban on rent-setting algorithms, citing anti-competitive concerns.

➥ Zohran Mamdani has inherited a surge of affordable housing projects, pushing new tenant-focused policies to tackle sky-high rents and homelessness.

Follow the Money

| MULTIFAMILY MIDTOWN WEST Yellowstone has landed a $326M loan to convert Manhattan’s 600-key Watson Hotel into 312 apartments, signaling a bold bet on adaptive reuse in NYC’s distressed property market. |

| OFFICE MIDTOWN EAST Societe Generale is weighing a relocation from 245 Park Ave., eyeing 500K SF elsewhere in Manhattan as top-tier office demand stays strong. |

| OFFICE MIDTOWN SL Green has closed its $720M acquisition of Park Avenue Tower with a $480M CMBS loan, reinforcing its dominance in Midtown's top-tier office market. |

| INVESTMENT SALES BROOKLYN Brooklyn's commercial investment sales dipped 16% to $6.6B in 2025 as market uncertainty and political unknowns put a chill on dealmaking. |

| RETAIL ROCKLAND COUNTY Rockland County’s Palisades Center, once among the nation’s largest malls, is headed to auction in February after years of mounting debt. |

| OFFICE MIDTOWN EAST Vornado landed $525M refinancing for One Park Avenue amid signs of Manhattan office market stability. |

| OFFICE QUEENS Edward J. Minskoff Equities secured a $72M loan from Citibank for One Aviation Plaza, now partly leased by U.S. Customs after the FAA's 2023 exit. |

| RETAIL MIDTOWN EAST Apollo Global Management has acquired $218M in debt tied to the retail condo at Manhattan’s St. Regis Hotel. |

📈 CHART OF THE WEEK

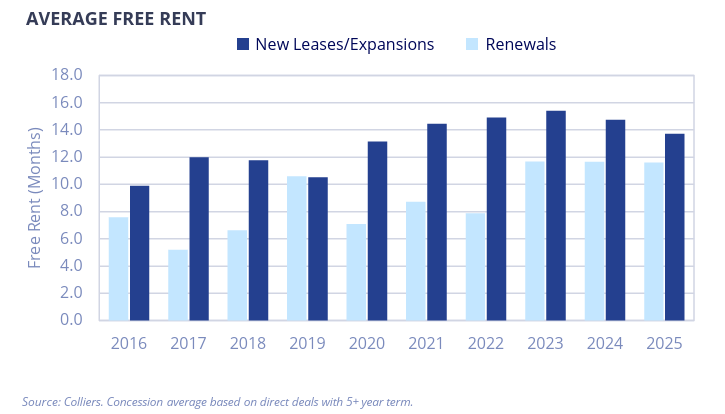

Average free rent in Manhattan office leases remained elevated in 2025, with new leases and expansions averaging around 13.7 months and renewals at 11.6 months.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with our national CRE Daily newsletter — or get hyper-local insights from CRE Daily Texas.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have {{ rp_num_referrals }} referrals, only {{ rp_num_referrals_until_next_milestone }} away from receiving {{ rp_next_milestone_name }}.