Good morning. As demand for top-tier office space heats up, major tenants are locking in leases years before buildings are even completed. The rush is reshaping Midtown, driven by AI expansion, limited supply, and a high-stakes race for the best addresses.

🎯 Interested in sponsoring CRE Daily NY? Reach thousands of active owners, investors, and operators across the five boroughs. Get in touch here.

Market Snapshot

|

|

||||

|

|

Trophy Chase

NYC’s Trophy Towers Are Leasing Before They're Built

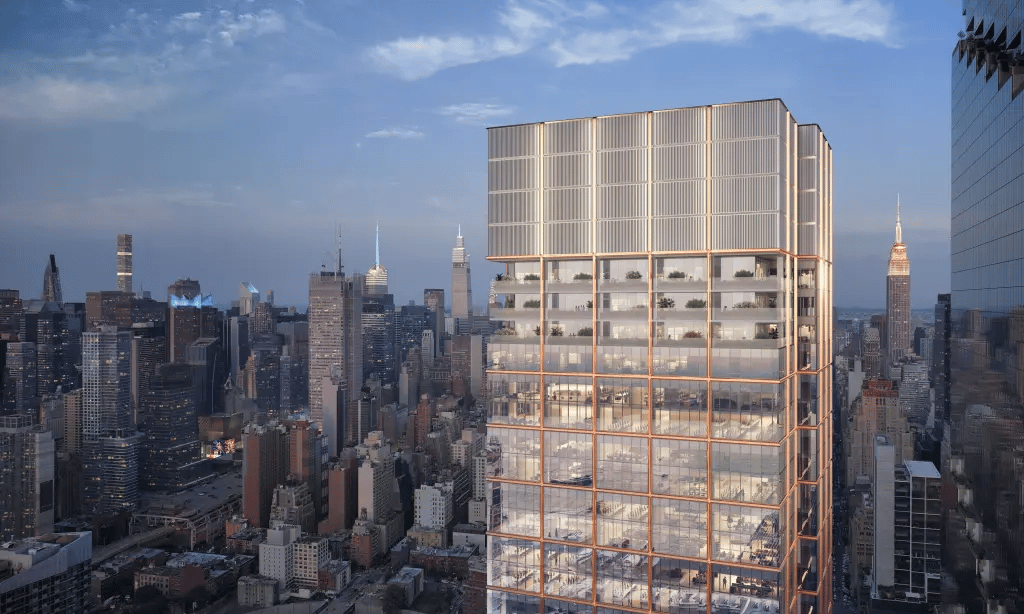

Photo Courtesy of Related

Big-name tenants are racing to lock in space years in advance as Manhattan’s top-tier office pipeline tightens.

Future towers: Major tenants are locking in space years ahead as demand for prime Midtown offices surges. Citadel, Deloitte, and Simpson Thacher have all signed on to towers still in development, including 350 Park Ave., 70 Hudson Yards, and a newly expanded 570 Park.

Office musical chairs: It’s a game of musical chairs for large tenants like Blue Owl, Capital One, and Two Sigma, all chasing limited space as new towers remain years away. With few options, lease renewals jumped in 2025, up to 44 from 36 the year prior.

AI takes space: AI firms are driving demand, making up 59% of Midtown South leasing last year. With 2 million square feet in active requirements for 2026, brokers say this is a lasting shift fueled by strong funding and in-office priorities.

Exclusive availability: As demand rises, rarely available space is quietly hitting the market. RXR is listing the top of 1211 Sixth Ave. for the first time in 20 years, while the new Rolex Building is offering select floors off-market. Even Chelsea’s IAC Building is leasing 83,000 SF with Hudson River views.

➥ THE TAKEAWAY

Scarcity hits Midtown: Midtown’s top-tier office market has flipped from oversupply to scarcity. With new developments years away, locking in space now is becoming a key competitive advantage.

Around New York

➥ NYC office investment jumped as buyers targeted discounted assets, signaling renewed pricing confidence after two years of limited transaction volume.

➥ Cohen Brothers faces potential foreclosure on multiple Manhattan offices as debt matures amid weak leasing, pressuring lenders and prompting restructuring talks.

➥ Lawmakers advanced a revised 485x tax break aimed at restarting rental development by lowering affordability requirements and restoring underwriting certainty.

➥ Union Square storefront leasing rebounded as investors bet on foot traffic recovery, supporting higher retail rents and stabilized ground-floor valuations.

➥ Office owners are adding premium amenities to compete for tenants, raising capex requirements but supporting rent growth in top-tier buildings.

➥ New York executives expect selective deal flow in 2026 as rate stability, loan extensions, and distress shape acquisition strategies.

Follow the Money

| OFFICE MANHATTAN Several NYC office owners shelved residential conversions amid higher costs, zoning hurdles, and weaker economics, signaling fewer near-term supply additions. |

| DEVELOPMENT MIDTOWN Extell entered contract for a Midtown assemblage, positioning Gary Barnett for a large-scale development play as land trades reset pricing. |

| OFFICE MIDTOWN Flagstar opened a Park Avenue private client office, targeting high-net-worth deposits and lending growth in New York. |

| MULTIFAMILY FINANCIAL DISTRICT Developers secured a $218M loan to convert a Financial District office building into housing, advancing the feasibility of adaptive reuse despite capital constraints. |

| OFFICE MURRAY HILL A Vornado joint venture closed $250M financing for a Manhattan asset, extending the runway amid refinancing pressure. |

| MULTIFAMILY BROOKLYN A proposed Bed-Stuy development could deliver roughly 2,000 units, signaling continued growth in Brooklyn's multifamily pipeline. |

📈 CHART OF THE WEEK

Manhattan rents keep climbing because tight supply has pushed demand into older, prewar buildings—where rents jumped 11.3% in 2025—driving a 6.4% rise in the borough’s median asking rent even as prices in newer developments declined.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with our national CRE Daily newsletter — or get hyper-local insights from CRE Daily Texas.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have {{ rp_num_referrals }} referrals, only {{ rp_num_referrals_until_next_milestone }} away from receiving {{ rp_next_milestone_name }}.